NEW YORK (CNNMoney)

QE3 is on track to be its largest bond-buying program yet, if it follows the path predicted by Wall Street.

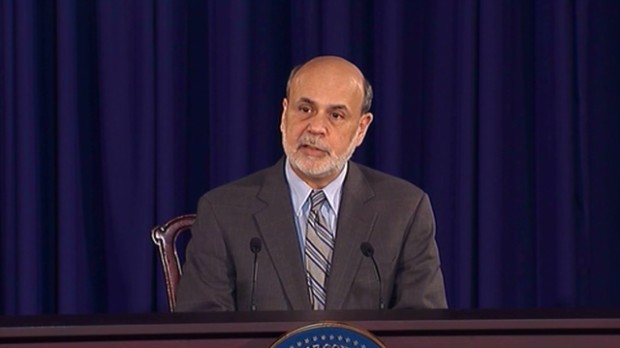

The Fed was expected to wind down its third round of quantitative easing, known as QE3, at the end of this year. But most predictions are now well into 2014, with some as far out as June.Given this environment and the leadership transition as Ben Bernanke's term ends in January, the Fed will likely continue its current stimulus program at full blast -- buying $85 billion in bonds each month -- until at least March 2014.

That means QE3 could total around $1.6 trillion, calculates Paul Ashworth of Capital Economics. That's more than either of its two predecessors. In contrast, QE1 totaled $1.5 trillion and the second round of stimulus added up to about $600 billion.

Related: 3 reasons why Fed may not taper until 2014

"There is a danger that the Fed has missed its window of opportunity," Ashworth said in a note. "If it's waiting for some degree of fiscal certainty, this really could turn into QEternity."

With bond purchases of this magnitude, the risks to financial stability are rising.

Stocks:

Most of the money created by the Fed is gathering dust in bank reserves and has not been making its way out to Main Street. Since the Fed launched its latest bond-buying program in September 2012, bank reserves have increased by about $800 billion, whereas the currency circulating in the economy has increased by only $80 billion.

Meanwhile, repeated rounds of quantitative easing have fueled stock gains to the point where some economists say prices may no longer be reasonable.

"Asset prices are higher than they should be based on fundamentals. Companies are making profits, but they're not making profits off of higher sales -- they're making profits off of constraining costs and particularly labor," said Catherine Mann, a finance professor at Brandeis University and a former Fed economist.

The longer QE continues, the more dramatic stocks could fall once the end of stimulus is in sight.

Continue Reading at ... http://money.cnn.com/2013/10/28/news/economy/federal-reserve-qe-stimulus/