Russia And Mexico Both Buy Nearly $1 Billion Worth of Gold in March

Submitted by Tyler Durden on 04/24/2012 08:41 -0400From GoldCore

Russia And Mexico Both Buy Nearly $1 Billion Worth of Gold in March

Gold’s London AM fix this morning was USD 1,638.75, EUR 1,244.68, and GBP 1,014.83 per ounce. Yesterday's AM fix was USD 1,632.00, EUR 1,240.97 and GBP 1,014.42 per ounce.

Silver is trading at $30.85/oz, €23.43/oz and £19.10/oz. Platinum is trading at $1,550.00/oz, palladium at $671.25/oz and rhodium at $1,350/oz.

Gold fell $3.80 or 0.23% in New York yesterday and closed at $1,638.20/oz. Gold has been trading mostly sideways in Asia and within a narrow 8 point spread. In European trading it remains near the close seen in New York yesterday.

Cross Currency Table – (Bloomberg)

The perfect storm trifecta of bad political and economic news yesterday out of France, Holland and Germany led to risk off and falls in many markets. Gold performed well and was resilient considering the sell off seen in equity markets.

Dutch Prime Minister Mark Rutte speaks in parliament today after tendering his Cabinet’s resignation to break a deadlock over further austerity.

French President Nicolas Sarkozy and Francois Hollande will face off in a 2nd round ballot on May 6th and the prospect of Hollande taking power is making European markets jittery.

The euro region has government debt at 87.2% of GDP last year, which is the highest since the start of the euro in 1999.

Manufacturing data from Europe and China contracted in data released yesterday showing how economic conditions appear to be deteriorating.

With the euro zone political landscape in crisis mode and data showing business contracting many investors are putting their capital in dollars and US Treasuries.

Gold 1 Year Chart – (Bloomberg)

So far gold has not been a prime beneficiary of these risks but this will likely change soon – especially if financial conditions deteriorate which seems very likely.

Gold has recently displayed short term correlations with paper assets such as equities and bonds but these correlations will again be shown to be fleeting as gold’s long term inverse correlation with paper assets will reassert itself in the coming months.

Mexico, Russia and Central Banks Continue Diversifying into Gold

While gold demand from the western investors and store of wealth buyers has fallen in recent months, central bank demand continues to be very robust and this is providing strong support to gold above the $1,600/oz level.

IMF data released overnight shows that Mexico added 16.8 metric tons of gold valued at about $906.4 million to its reserves in March.

Russia continued to diversify its foreign exchange reserves and increased its gold reserves by about 16.5 tons according to a statement by its central bank on April 20.

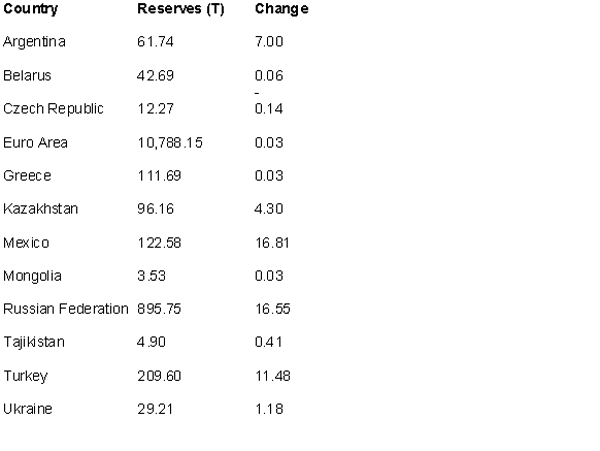

Changes to Gold Holdings in IMF (March) - Reuters Global Gold Forum

Other creditor nations with large foreign exchange reserves and exposure to the dollar and the euro including Turkey and Kazakhstan also increased their holdings of gold according to the International Monetary Fund data.

Mexico raised its reserves to 122.6 tons last month when gold averaged $1,676.67 an ounce.

Turkey added 11.5 tons, Kazakhstan 4.3 tons, Ukraine 1.2 tons, Tajikistan 0.4 ton, and Belarus 0.1 tonnes, according to the IMF.

Ukraine, Czech Republic and Belarus also had modest increases in their gold reserves.

Central banks are expanding reserves due to concerns about the dollar, euro, sterling and all fiat currencies.

There is an increasing realisation amongst central bankers that gold is a less risky alternative to most paper currencies and a recent survey showed that that majority of central bank reserves managers were favourable towards gold.

Signifying the mood of caution among the world’s central bankers, 71% of those polled said gold was a more attractive investment than it had been at the start of last year.

Central banks added 439.7 tons last year, the most in almost five decades, and may buy a similar amount if not more in 2012, the World Gold Council and many analysts believe.

Turkey’s central bank increased the proportion of required reserves that commercial banks can deposit in gold last year. The changes have increased the amount of bullion the country, which owns 209.6 tons, declares in its official reserves.

President Vladimir Putin

Gold accounts for about 3.9 percent of Mexico’s total reserves and 9.7 percent of Russia’s, according to the World Gold Council. That compares with more than 70 percent for the U.S. and Germany, the biggest bullion holders, the data show.

The IMF data records the People’s Bank of China data showing that at the end of March China’s gold reserves remained unchanged at 33.88 million ounces.

This seems hard to believe and it remains likely that China is again quietly accumulating gold reserves and the PBOC will announce a material increase in their reserves when they are ready to do so.

OTHER NEWS

(Bloomberg) -- Russian Gold Holdings Rise to 28.8 Million Troy Ounces in March

Russia’s central bank increased its gold holdings to 28.8 million troy ounces last month, from 28.3 million troy ounces at the end of February, according to a statement published on its website today.

The stockpile was valued at $47.8 billion as of April 1, compared with $50.2 billion a month earlier, Bank Rossii said.

(Bloomberg) -- Gold Is ‘Still in An Uptrend,’ Credit Suisse Says in Report

Gold is “still in an uptrend and with the exception of silver, the sector is not overvalued,” Credit Suisse said in an e-mailed report today.

(PTI) -- India Post offers 6 pc discount on gold coins

India Post today said it will offer a six per cent discount on gold coins on the occasion of Akshya Tritya.

Customers would be able to purchase gold coins of any denomination and get a six per cent discount from across 31 designated post offices in the Delhi Postal Circle, India Post said in a statement.

These include post offices in Ashok Vihar, Civil Lines, Connaught Place, Greater Kailash, Hauz Khas, Janakpuri B-I and Paschim Vihar, among others.

'Akshya Tritya', a day in the Hindu calendar, is considered auspicious for buying the precious metal. Also known as 'Akha Teej', Akshya Tritya this year will be celebrated on April 24. The gold coins are available in denominations of 0.5 grams, 1 grams, 5 grams, 8 grams, 10 grams, 20 grams and 50 grams of 24 carat with 99.99 per cent purity.

India Post, in association with World Gold Council and Reliance Money Infrastructure Ltd, commenced the sale of gold coins manufactured by Valcambi, Switzerland. This arrangement was started in October 2008.

India Post at present sells gold coins through more than 800 post offices across the country.

http://www.zerohedge.com/news/russia-and-mexico-both-buy-nearly-1-billion-worth-gold-march